In today’s complex financial landscape, many individuals find themselves navigating challenges that can hinder their economic well-being. This resource is designed to empower readers with the knowledge and strategies necessary to reclaim their financial stability. By understanding the factors that impact one’s financial health, individuals can take informed steps towards improvement.

Whether facing obstacles due to past decisions or unforeseen circumstances, the journey towards restoring financial credibility can seem daunting. However, with the right tools and insights, anyone can enhance their situation and achieve long-term success. This guide offers practical advice and actionable steps to assist individuals in regaining control over their financial lives.

By focusing on fundamental principles and effective techniques, readers will discover how to address common issues and build a solid foundation for future financial endeavors. Empowerment through education is the key to overcoming adversity and fostering a brighter economic future. With determination and the right approach, a fresh start is always within reach.

Understanding Credit Scores

Grasping the concept of numerical evaluations that reflect financial responsibility is essential for anyone seeking to enhance their economic standing. These assessments play a crucial role in determining access to loans, interest rates, and various financial products.

The Components of Financial Assessments

Numerical evaluations are influenced by several key factors, each contributing to the overall picture of an individual’s financial behavior:

- Payment History: Timely payments on bills and loans are vital for a positive rating.

- Debt Levels: The total amount owed compared to available credit influences the score significantly.

- Credit History Length: A longer financial history can positively impact evaluations.

- Types of Credit: Having a mix of different financial products, such as loans and credit lines, can be beneficial.

- Recent Credit Inquiries: Multiple inquiries for new credit within a short period may negatively affect the score.

Improving Your Financial Evaluation

Enhancing one’s numerical assessment requires strategic actions, including:

- Consistently making timely payments.

- Reducing outstanding debt.

- Monitoring reports for inaccuracies.

- Avoiding unnecessary new credit applications.

By understanding and actively managing these elements, individuals can work towards achieving a favorable evaluation, thereby improving their financial opportunities.

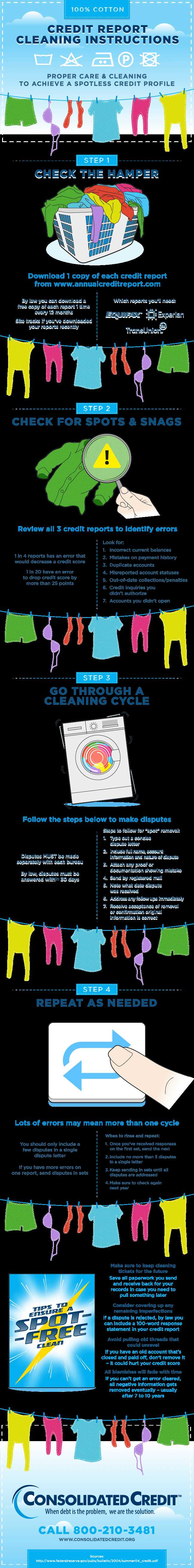

Common Credit Report Errors

Understanding the frequent inaccuracies that may appear in financial assessments is crucial for maintaining a healthy financial profile. Many individuals are unaware that their evaluations can contain mistakes, which can significantly impact their financial opportunities.

Types of Frequent Inaccuracies

Common discrepancies found in financial assessments include:

- Incorrect personal details, such as name or address

- Outdated account information

- Inaccurate payment histories

- Accounts that do not belong to the individual

- Duplicate entries for the same account

Consequences of Errors

These inaccuracies can lead to various challenges, including:

- Difficulties in securing loans or credit lines

- Higher interest rates due to perceived risk

- Loss of potential housing opportunities

- Overall damage to financial reputation

Regularly reviewing assessments for these common errors is a proactive step toward ensuring financial well-being.

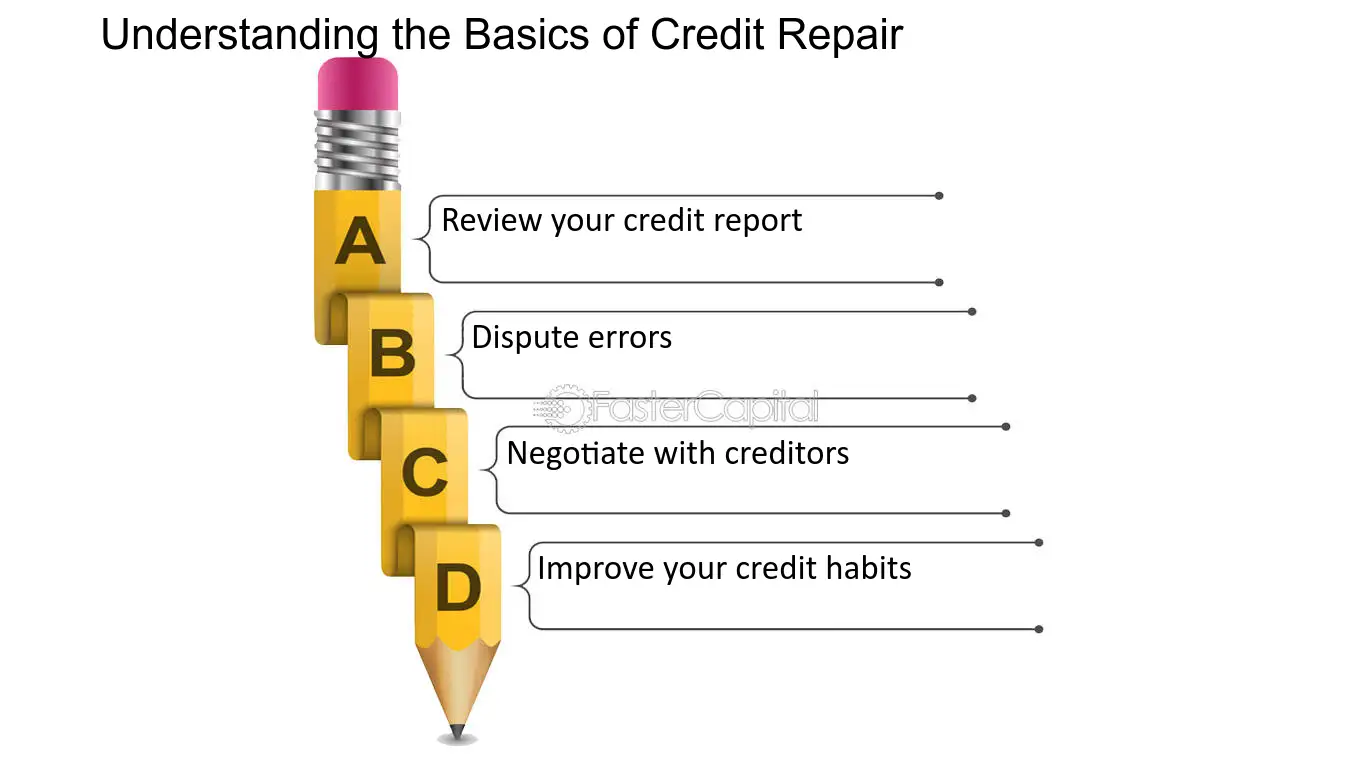

Strategies for Improving Credit

Enhancing one’s financial reputation is essential for achieving various life goals, such as securing loans or making significant purchases. By employing effective techniques, individuals can foster a positive image and increase their chances of favorable financial opportunities.

Key methods for achieving a better financial standing include managing outstanding obligations, maintaining a consistent payment history, and monitoring financial reports for inaccuracies. Below are some practical strategies to consider:

| Strategy | Description |

|---|---|

| Pay Bills on Time | Consistently settling obligations on their due dates helps build reliability. |

| Reduce Debt Utilization | Keeping debt levels low compared to available limits improves financial ratios. |

| Regularly Check Financial Reports | Reviewing reports for errors ensures accuracy and allows for timely corrections. |

| Establish a Diverse Credit Portfolio | Having various types of credit can demonstrate responsible management skills. |

Disputing Inaccurate Information

Ensuring the accuracy of your financial records is crucial for maintaining a solid reputation. Errors can occur, and addressing them promptly is essential to safeguard your interests. Disputing incorrect entries effectively can lead to improved outcomes in your financial standing.

To begin the dispute process, gather all relevant documentation that supports your claims. This evidence should clearly demonstrate the inaccuracies you wish to challenge. Presenting a well-organized case increases the likelihood of a favorable resolution.

| Step | Description |

|---|---|

| 1 | Identify the errors in your records. |

| 2 | Collect supporting documents and evidence. |

| 3 | Submit a formal dispute to the relevant agency. |

| 4 | Monitor the status of your dispute. |

After submitting your dispute, it’s important to follow up and ensure that the issue is being addressed. Staying proactive in this process helps protect your financial integrity and ensures that any errors are rectified in a timely manner.

Building a Positive Credit History

Establishing a strong financial reputation is essential for long-term economic well-being. This involves various strategies that can enhance your standing with lending institutions and improve your chances of obtaining favorable terms for future loans.

One of the fundamental aspects of fostering a good financial record is timely payments. Consistently meeting your obligations demonstrates reliability and financial responsibility. Additionally, maintaining a manageable level of debt and utilizing credit judiciously can further reinforce a positive perception among creditors.

| Strategy | Description |

|---|---|

| On-time Payments | Ensure all bills and loans are paid by their due dates to avoid negative marks. |

| Debt Management | Keep balances low relative to your credit limits to improve your utilization ratio. |

| Diverse Credit Types | Incorporate different types of credit, such as installment loans and revolving credit, for a balanced profile. |

Effective Debt Management Techniques

Managing financial obligations effectively requires a strategic approach that emphasizes planning and discipline. Individuals can navigate their monetary responsibilities by adopting techniques that enhance their financial literacy and foster sustainable habits.

Creating a Comprehensive Budget

A well-structured budget serves as a foundation for financial management. It enables individuals to track income and expenditures, ensuring that spending aligns with financial goals. Regularly reviewing and adjusting the budget can lead to improved financial health.

Prioritizing Payments

Establishing a hierarchy for payments is crucial in avoiding penalties and reducing interest costs. Focusing on high-interest debts first can alleviate financial strain over time. Consistent payments also bolster one’s financial standing and pave the way for better future opportunities.

Utilizing Credit Counseling Services

Many individuals facing financial challenges can benefit from professional guidance to navigate their situations effectively. Seeking assistance from specialized organizations can provide valuable insights and resources for improving overall financial health. These services typically focus on educating clients about money management and developing personalized strategies for better fiscal decisions.

Benefits of Professional Guidance

Engaging with knowledgeable advisors offers several advantages:

- Personalized financial assessments to identify specific challenges.

- Access to educational materials that enhance financial literacy.

- Structured plans to tackle outstanding debts and manage expenses.

Finding the Right Service

Choosing an appropriate counseling service is crucial for effective support. Consider the following factors:

- Research the organization’s reputation and qualifications.

- Look for accredited services with a track record of success.

- Evaluate the types of programs offered and their suitability for your needs.

By leveraging these resources, individuals can work toward a more stable financial future and regain control over their financial circumstances.

Long-Term Financial Planning Tips

Effective strategies for managing your finances over the long haul are essential for achieving stability and growth. These approaches encourage individuals to set clear goals, assess their current situation, and make informed decisions that can secure their financial future.

Establish Clear Objectives: Define what you want to accomplish financially, whether it’s saving for retirement, purchasing a home, or funding education. Setting specific, measurable targets helps to guide your planning process.

Regularly Review Your Budget: Periodic assessment of your income and expenditures is crucial. Adjust your budget as necessary to align with your long-term aspirations and accommodate any changes in your financial situation.

Invest Wisely: Consider diversifying your investment portfolio to spread risk and maximize potential returns. Research various options and consult with financial advisors to make informed choices.

Build an Emergency Fund: Having a safety net can provide peace of mind and protect against unexpected expenses. Aim to save at least three to six months’ worth of living expenses to ensure financial resilience.

Educate Yourself: Continuously seek knowledge about financial markets, investment strategies, and personal finance. The more informed you are, the better equipped you’ll be to make sound financial decisions.

Legal Rights in Credit Repair

Understanding the legal framework surrounding financial recovery is essential for individuals seeking to enhance their economic standing. Various regulations provide protections and empower consumers in their journey toward financial stability.

Key legal rights include:

- Right to Accurate Information: Consumers are entitled to have their financial history accurately represented.

- Right to Dispute Inaccuracies: Individuals can challenge incorrect entries in their financial records.

- Right to Privacy: Personal information must be handled with confidentiality and care.

- Right to Fair Treatment: Consumers should not face discrimination based on their financial history.

These rights are protected by various laws, ensuring that individuals can seek assistance without fear of exploitation. Understanding and asserting these rights is crucial for effective management of one’s financial health.

Understanding Credit Repair Scams

In today’s financial landscape, numerous individuals seek assistance to enhance their financial standing. Unfortunately, this desire for improvement can make people vulnerable to deceptive practices. Unscrupulous entities often capitalize on this vulnerability, promising swift solutions that rarely deliver on their claims.

Many fraudulent operations employ aggressive marketing tactics, luring clients with guarantees of quick fixes or miraculous results. They may ask for upfront fees without providing transparent information about their methods. It’s crucial to recognize the warning signs, such as unrealistic promises and lack of proper documentation.

Awareness is key in protecting oneself from these scams. Researching potential service providers and seeking reviews can help ensure a safer path to financial health. Always prioritize organizations that adhere to ethical practices and are willing to provide clear, detailed explanations of their services.

Resources for Financial Education

Accessing reliable information is crucial for enhancing financial literacy and making informed decisions. A variety of resources are available to individuals seeking to improve their understanding of personal finance and budgeting strategies.

Consider exploring the following categories of resources:

- Books:

- Look for titles that focus on financial management, investment strategies, and wealth building.

- Seek out recommendations from reputable financial experts and organizations.

- Online Courses:

- Many platforms offer free or low-cost courses on topics like budgeting, investing, and retirement planning.

- Interactive lessons can help reinforce learning and practical application.

- Podcasts and Webinars:

- Listen to industry professionals discuss current trends and tips in finance.

- Participate in live webinars for real-time insights and Q&A sessions.

- Financial Blogs:

- Follow reputable blogs for regular updates on personal finance topics.

- Engage with the community through comments and discussions for broader perspectives.

- Community Workshops:

- Check local organizations or libraries for workshops aimed at enhancing financial skills.

- Networking with others in your community can provide support and motivation.

Utilizing these resources can empower individuals to take charge of their financial futures and cultivate a healthier relationship with their finances.

Creating a Personal Budget Plan

Establishing a financial framework is essential for managing your resources effectively. This process allows individuals to track income and expenses, ensuring that funds are allocated wisely. A well-structured approach can lead to greater financial stability and empower one to achieve long-term goals.

Assessing Your Financial Situation

Begin by evaluating your current monetary standing. List all sources of income, including salaries, bonuses, and any additional revenue streams. Next, outline your expenses, distinguishing between fixed costs, such as rent or utilities, and variable expenses, like groceries and entertainment. This comprehensive overview will provide a clear picture of your financial landscape.

Setting Financial Goals

Once you have a thorough understanding of your finances, establish specific objectives. These might include saving for emergencies, paying off debts, or planning for future investments. Prioritizing these goals helps in creating a focused budget that aligns with your aspirations. Commit to reviewing and adjusting your plan regularly to stay on track and adapt to any changes in your financial circumstances.