This section aims to provide comprehensive insights into enhancing one’s financial standing. By following effective strategies and methodologies, individuals can achieve a more stable economic foundation, leading to better opportunities for growth and success.

Understanding the various aspects of financial health is essential. This guide will delve into practical steps that can be taken to overcome challenges and foster a more favorable monetary situation. Through careful planning and informed decision-making, anyone can navigate the complexities of personal finance.

Equipped with the right knowledge, individuals will learn how to address past financial missteps. This journey towards revitalization will empower readers to take control of their economic future, ensuring a brighter outlook and increased confidence in managing their financial affairs.

Understanding Credit Repair Basics

This section provides essential insights into improving one’s financial standing. It outlines the fundamental principles that govern the process of enhancing one’s financial reputation and securing better terms for future transactions.

Key concepts include:

- Monitoring financial history

- Identifying inaccuracies in records

- Strategies for enhancing scores

- Effective communication with financial institutions

To embark on this journey, individuals should consider the following steps:

- Gather all relevant financial documents.

- Review reports thoroughly for errors.

- Initiate disputes for any inaccuracies found.

- Implement budgeting techniques to manage expenses.

- Stay informed about financial literacy.

By following these guidelines, individuals can lay a solid foundation for achieving their financial objectives and improving their overall standing in the market.

Common Credit Issues Explained

Understanding the typical challenges individuals face regarding their financial history is essential for effective management and improvement. Various factors can contribute to these hurdles, affecting one’s ability to secure favorable terms for loans and other financial products.

Frequent Problems

- Late Payments: Missing payment deadlines can significantly impact your financial standing.

- High Utilization: Excessive use of available credit limits may raise concerns among lenders.

- Inaccurate Information: Errors on financial reports can lead to misjudgments regarding your creditworthiness.

Impact of Issues

- Access to Financial Products: Poor financial histories often result in higher interest rates or outright denials.

- Insurance Premiums: Certain providers may charge more for coverage based on financial behavior.

- Employment Opportunities: Some employers review financial histories during the hiring process, affecting job prospects.

Steps to Assess Credit Reports

Evaluating personal financial evaluations is a crucial process for understanding one’s financial standing. This examination helps individuals identify areas that require attention and improvement, ultimately guiding them towards better financial health.

Understanding the Importance

Recognizing the significance of reviewing financial evaluations can lead to informed decisions. It empowers individuals to take control of their financial future by:

- Identifying inaccuracies that may negatively affect scores.

- Understanding how various factors influence financial standing.

- Gaining insights into spending and borrowing habits.

Steps to Analyze Financial Evaluations

- Obtain your financial evaluations from reliable sources.

- Review each section thoroughly, noting discrepancies.

- Highlight any negative items that require clarification or correction.

- Assess your overall financial behavior reflected in the evaluations.

- Consider consulting a professional for further guidance if needed.

Strategies for Disputing Errors

When inaccuracies appear in financial records, addressing them promptly is essential. Taking the right approach can significantly improve the chances of achieving a favorable outcome. This section outlines effective methods for challenging discrepancies, ensuring that individuals are equipped to handle such situations effectively.

1. Gather Documentation

Collecting relevant documents is crucial for substantiating your claims. This includes statements, receipts, and any correspondence related to the disputed items. Having a comprehensive set of evidence strengthens your position and provides clarity to the reviewing party.

2. Draft a Clear Dispute Letter

Writing a concise and precise letter outlining the specific errors is vital. Clearly state the inaccuracies and provide supporting evidence. Make sure to include your contact information and request a timely response. A well-structured letter can expedite the review process.

3. Follow Up Regularly

After submitting your dispute, it’s important to maintain communication. Regularly follow up to check on the status of your case. Persistence shows your commitment to resolving the matter and can prompt quicker action from the relevant parties.

4. Know Your Rights

Familiarize yourself with the regulations that protect individuals from unfair practices. Understanding these rights empowers you to challenge any negligence effectively and ensures that your concerns are taken seriously.

5. Consider Professional Assistance

If the process becomes overwhelming, seeking guidance from professionals who specialize in such disputes can be beneficial. They possess the expertise to navigate the complexities involved, increasing the likelihood of a successful resolution.

Building a Credit Repair Plan

Creating a strategy for enhancing your financial standing is crucial for achieving long-term stability. This involves a systematic approach to assess your current situation, identify areas for improvement, and implement actionable steps to enhance your overall financial health.

Assessing Your Financial Situation

The first step in developing your strategy is to conduct a thorough evaluation of your financial status. This includes:

- Reviewing your financial statements

- Analyzing your spending habits

- Identifying outstanding obligations

- Determining your income sources

Implementing Effective Strategies

Once you have a clear understanding of your current situation, you can move on to implementing targeted strategies. Consider the following actions:

- Set realistic and achievable goals

- Establish a budget that reflects your priorities

- Communicate with your creditors to negotiate terms

- Monitor your progress regularly and adjust your plan as needed

By following these steps, you will create a comprehensive approach to enhancing your financial well-being.

Tools for Effective Credit Management

Maintaining a healthy financial profile requires the use of various resources and strategies. These tools can help individuals manage their obligations and enhance their financial standing, ultimately leading to greater stability and opportunities.

- Budgeting Software: Utilizing financial planning applications allows users to track income and expenses, fostering better decision-making.

- Financial Literacy Resources: Accessing educational materials can empower individuals to understand financial concepts and make informed choices.

- Monitoring Services: Regularly checking financial reports helps in identifying discrepancies and managing overall financial health.

Incorporating these instruments into daily life not only aids in meeting obligations but also builds a solid foundation for future financial endeavors. Developing good habits around these resources can lead to long-term success and security.

Legal Rights in Credit Repair

Understanding your legal entitlements is crucial when addressing financial challenges. Individuals navigating the complexities of their financial histories must be aware of the protections afforded to them by various regulations. These protections ensure that consumers can seek assistance while being treated fairly and ethically.

There are several key rights that individuals should be aware of:

| Right | Description |

|---|---|

| Transparency | Consumers have the right to receive clear information regarding the services offered and associated costs. |

| Cancellation | Individuals may cancel agreements within a specified time frame, allowing them to reconsider their decisions. |

| Protection from Fraud | Consumers are safeguarded against deceptive practices and misinformation from service providers. |

| Access to Records | Individuals have the right to obtain copies of their financial records, facilitating informed decisions. |

Being aware of these rights empowers individuals to make educated choices and seek the help they need without falling prey to unethical practices.

Educating Clients on Credit Health

Ensuring individuals are well-informed about their financial well-being is crucial for fostering responsible habits and long-term stability. By providing comprehensive guidance, you empower clients to make informed decisions that positively influence their economic standing.

Key areas of focus for enhancing clients’ financial literacy include:

- Understanding Financial Scores: Clients should grasp how various factors affect their scores and the implications of these ratings on their financial opportunities.

- Recognizing Responsible Practices: Educating clients about prudent financial behaviors, such as timely bill payments and maintaining low balances, can significantly impact their economic health.

- Identifying Common Pitfalls: Awareness of frequent mistakes, such as overutilization of available funds or neglecting to review reports, helps clients avoid detrimental outcomes.

- Strategies for Improvement: Offering actionable steps, like establishing a budget and monitoring their financial status, encourages proactive engagement in their financial journey.

Through a structured educational approach, clients can develop a clearer understanding of their financial landscape and make choices that foster positive changes. This empowerment not only leads to improved economic conditions but also builds confidence in managing financial responsibilities effectively.

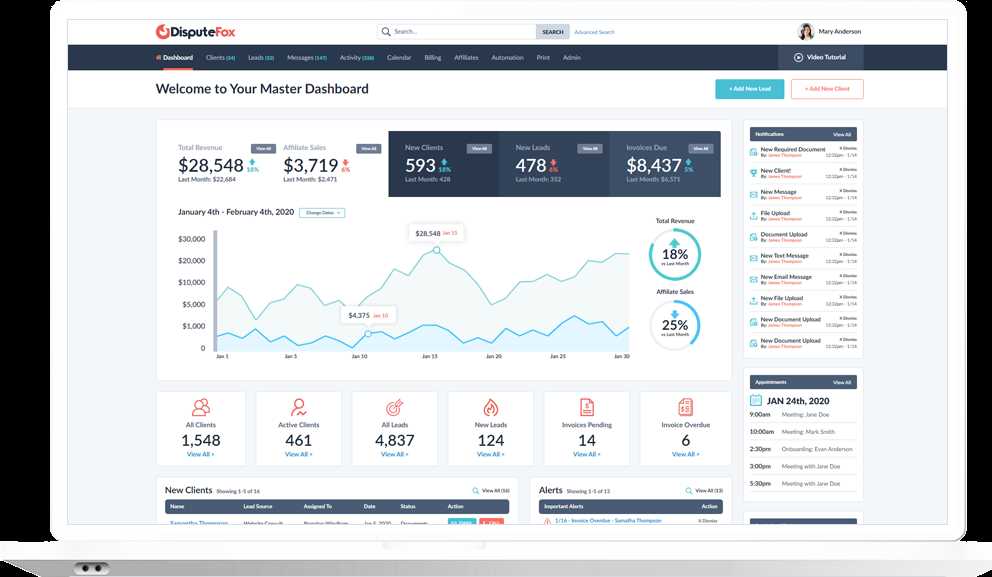

Monitoring Progress Regularly

Keeping track of financial health is essential for making informed decisions and achieving long-term stability. By regularly assessing your standing, you can identify areas that need attention and ensure that you are moving in the right direction. This process not only helps in recognizing improvements but also in addressing potential issues before they escalate.

Establishing a Monitoring Routine

To effectively oversee your financial progress, it is beneficial to create a routine that includes regular check-ins. Setting specific intervals–such as monthly or quarterly–allows you to evaluate your situation consistently. During these assessments, review important factors such as payment histories, outstanding obligations, and overall financial behavior.

Utilizing Available Resources

Various tools and resources can aid in monitoring your standing effectively. Online platforms, mobile applications, and professional services offer valuable insights and analytics. Leveraging these resources can enhance your understanding and assist in making data-driven decisions that align with your financial objectives.

Networking with Financial Professionals

Building relationships with individuals in the financial sector is essential for gaining valuable insights and opportunities. Engaging with experts in finance can lead to beneficial collaborations and a deeper understanding of the industry.

Establishing connections with professionals such as accountants, loan officers, and financial advisors can provide access to a wealth of knowledge. Attending industry events, seminars, and workshops is an effective way to meet these individuals and expand your network. By actively participating in discussions and seeking advice, you can enhance your understanding of financial strategies and practices.

Moreover, maintaining ongoing communication with these contacts is crucial. Regular follow-ups and sharing relevant information can strengthen your professional ties and foster a sense of community. Utilizing online platforms like LinkedIn can also facilitate connections and enable you to engage with a broader audience.

Marketing Your Credit Repair Services

Promoting your financial enhancement services requires a strategic approach that effectively reaches your target audience. It’s essential to utilize various channels and techniques to create awareness and attract potential clients who may benefit from your offerings.

Utilize social media platforms to showcase success stories and share valuable insights related to financial improvement. Engaging content, such as tips and testimonials, can help build credibility and establish a connection with your audience. Consider leveraging paid advertising to target specific demographics, ensuring your message reaches those most likely to seek your assistance.

Networking within your community and forming partnerships with local businesses can also enhance your visibility. Attend relevant events and workshops to promote your services and connect with potential clients. Additionally, consider developing informative content, such as blogs or webinars, to educate your audience about financial health and the benefits of your services.

Finally, don’t underestimate the power of word-of-mouth referrals. Encouraging satisfied clients to share their experiences can significantly contribute to the growth of your client base. Providing exceptional service will not only retain clients but also transform them into advocates for your business.

Evaluating Success and Adjustments

In the process of enhancing financial profiles, it is crucial to assess the effectiveness of strategies implemented. This evaluation involves analyzing various metrics to determine whether the desired outcomes are being achieved and identifying areas for improvement.

Regular reviews allow individuals to make informed decisions about necessary modifications in their approach. This dynamic process ensures that methods remain relevant and effective in addressing ongoing challenges.

| Key Metrics | Evaluation Criteria | Adjustment Strategies |

|---|---|---|

| Progress Tracking | Assess changes in financial standing | Adjust techniques based on outcomes |

| Client Feedback | Gather insights on experiences | Refine practices to better meet needs |

| Time Investment | Analyze time spent versus results | Reallocate resources to more effective methods |