In the fast-paced world of vehicle maintenance, efficient management of service interactions is crucial for success. Establishing a clear framework for financial exchanges not only enhances customer satisfaction but also streamlines operations. This section delves into the fundamental concepts that underpin the financial aspects of automotive services, ensuring that both providers and clients have a seamless experience.

Understanding the nuances of cost assessment and documentation is key to fostering trust and transparency. By outlining specific steps for managing financial records, service providers can avoid misunderstandings and promote a culture of accountability. This guide will illuminate best practices and effective strategies for documenting every aspect of the transaction process.

Additionally, incorporating standardized methods for evaluating service expenses can lead to more accurate pricing and informed decision-making. With the right knowledge and tools, automotive professionals can enhance their service delivery, build lasting relationships with clients, and ultimately achieve greater business success.

Understanding Car Repair Billing

This section explores the essential aspects of financial documentation related to vehicle maintenance services. It aims to clarify the nuances involved in assessing costs, ensuring transparency, and enhancing customer trust through clear communication of expenses.

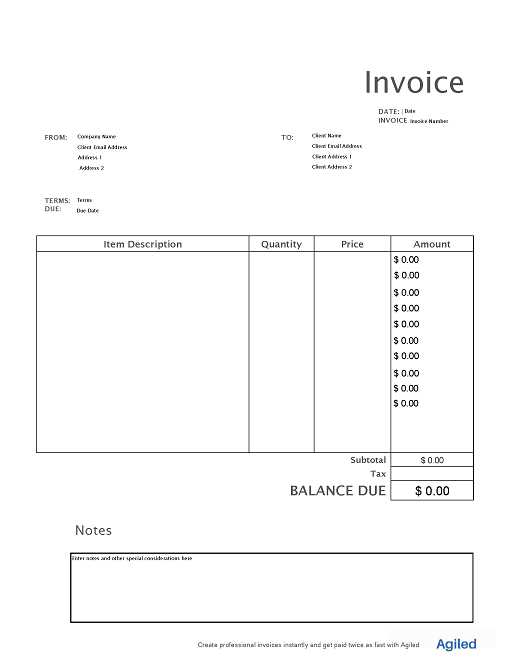

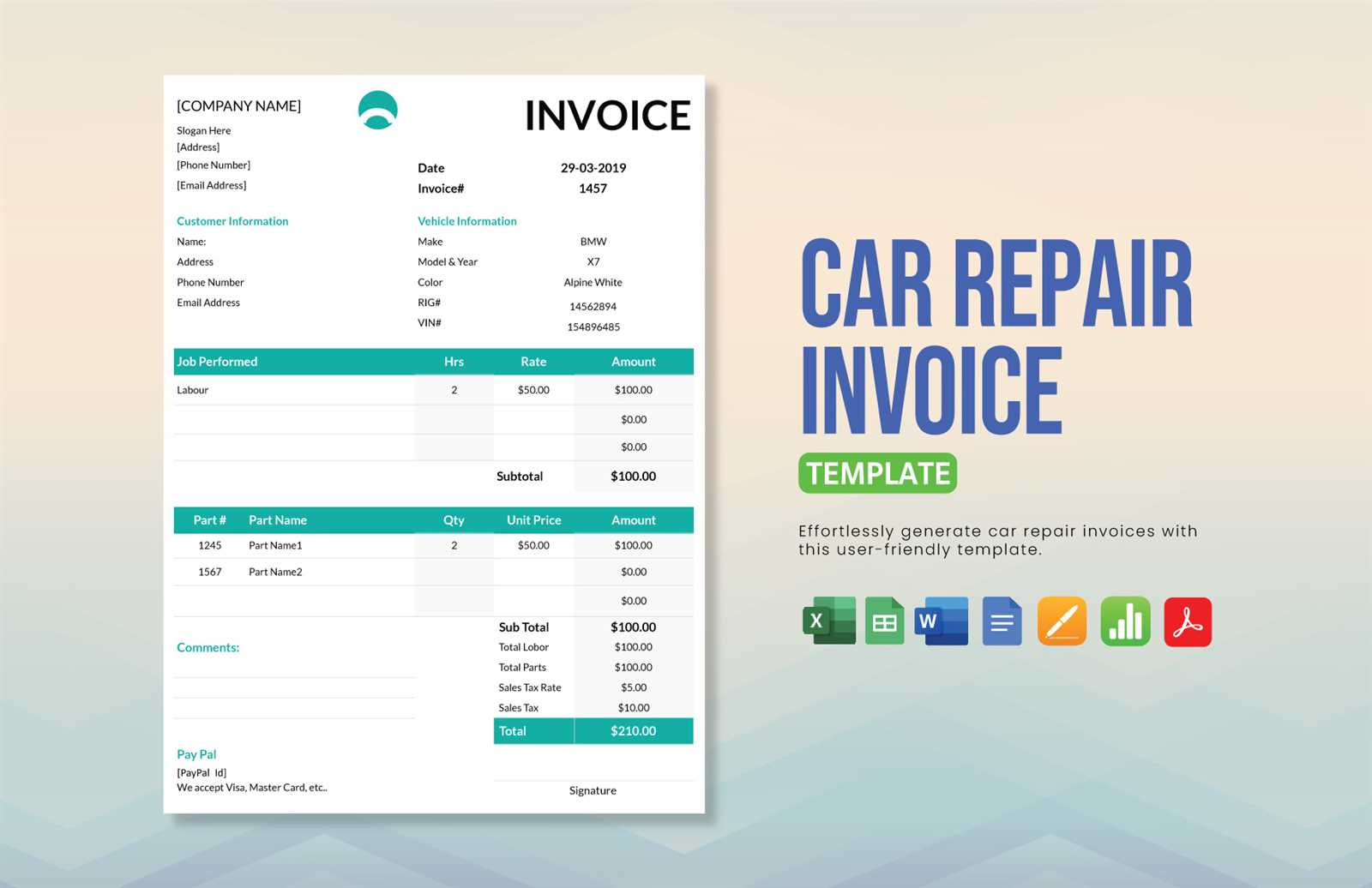

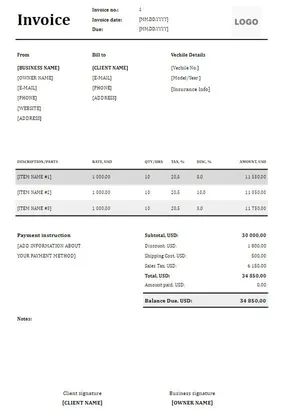

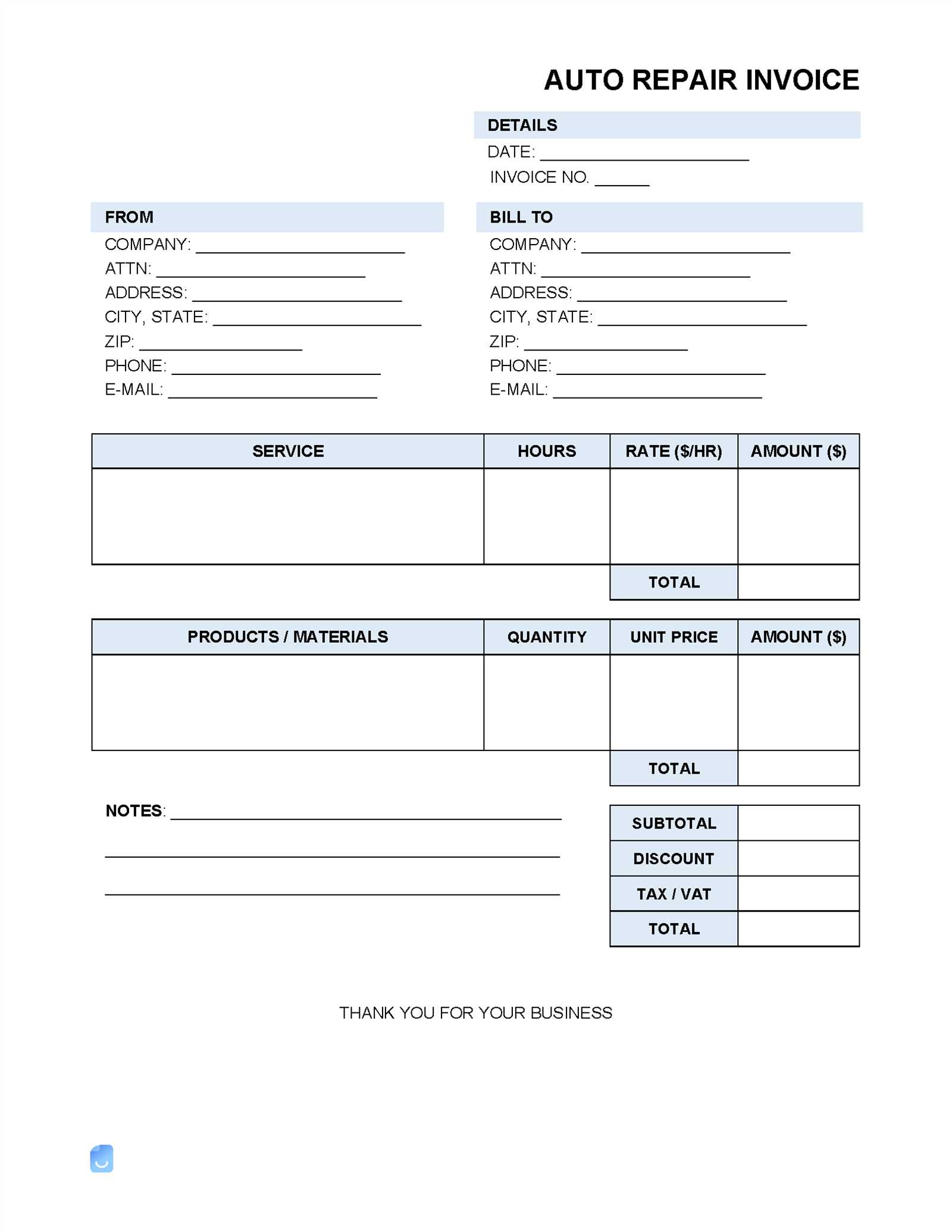

Components of Financial Statements

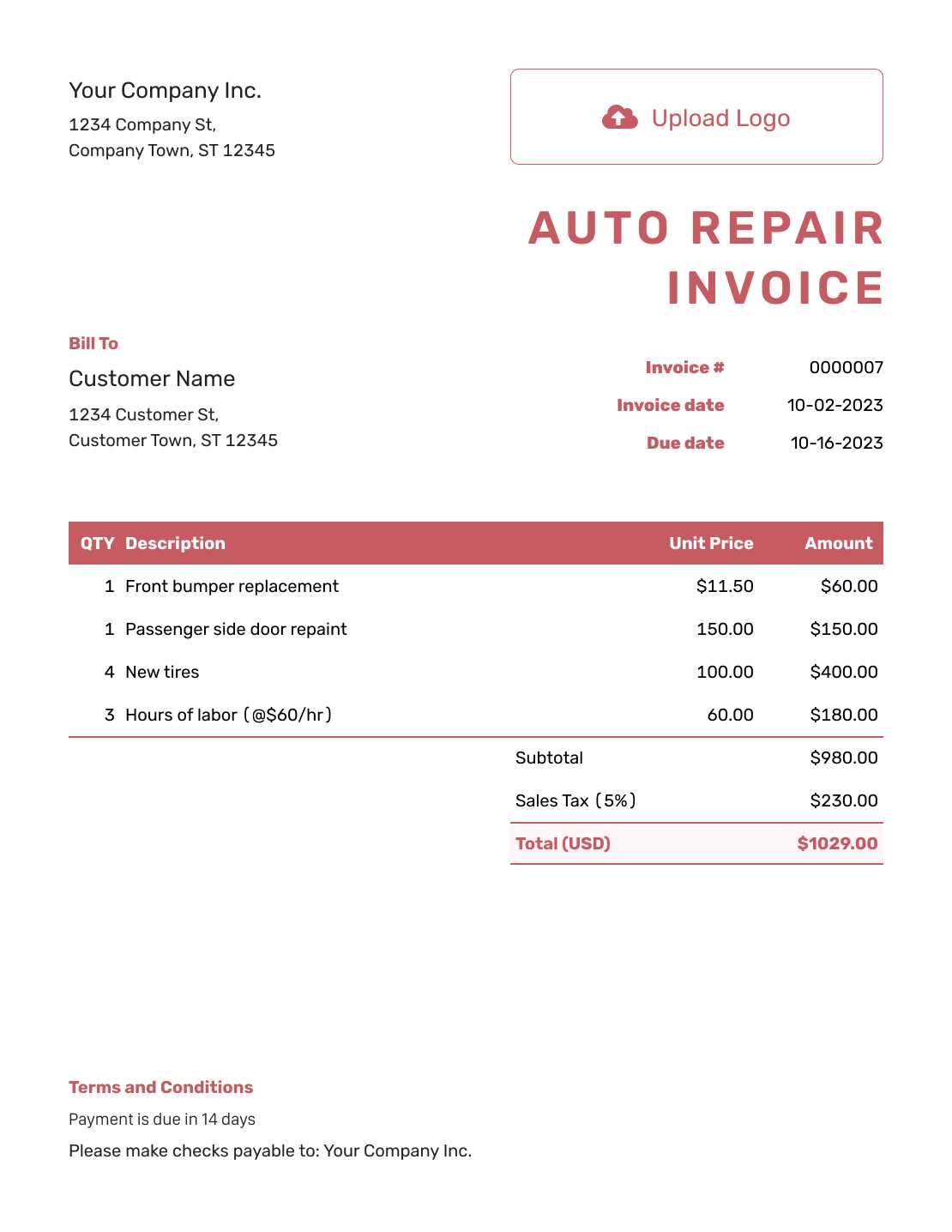

The key elements of these documents typically include labor charges, parts and materials costs, and any additional fees. Each component must be detailed to provide a comprehensive view of the overall expenditure. This transparency not only helps customers understand what they are paying for but also allows service providers to justify their pricing strategies.

Importance of Accurate Invoicing

Precise invoicing is crucial for maintaining a reputable business. Errors in financial documentation can lead to misunderstandings and dissatisfaction among clients. Implementing effective checks and balances in the invoicing process minimizes discrepancies, thereby fostering stronger relationships with customers and enhancing the credibility of the service provider.

Key Components of Billing Procedures

Understanding the essential elements that contribute to an effective financial management system is crucial for any service-oriented business. Each component plays a significant role in ensuring smooth transactions and fostering customer satisfaction. This section outlines the fundamental aspects that should be considered to optimize the financial processes involved.

1. Transparent Pricing Structure

A clear and straightforward pricing model is vital for building trust with clients. Transparency in costs helps customers understand what they are paying for and why. It is important to provide detailed estimates that outline each charge, ensuring that clients are well-informed throughout the transaction.

2. Efficient Documentation

Accurate record-keeping is essential for any organization. Documentation of services rendered, materials used, and labor hours spent enables businesses to maintain a comprehensive overview of their operations. This information is crucial for invoicing and serves as a reference for future engagements, enhancing overall efficiency.

Common Billing Errors to Avoid

In the realm of service transactions, accuracy is crucial to maintain customer trust and ensure smooth financial operations. Various mistakes can occur, leading to misunderstandings and dissatisfaction. Recognizing these pitfalls is essential for enhancing efficiency and clarity in financial documentation.

- Incorrect Itemization: Failing to accurately list all services provided can lead to disputes. Always double-check that every task is accounted for.

- Misleading Estimates: Providing estimates that do not reflect the final cost can frustrate clients. It’s vital to communicate potential variables clearly.

- Omitting Discounts: Neglecting to apply agreed-upon discounts or promotions can result in customer dissatisfaction. Ensure all applicable reductions are included.

- Math Errors: Simple calculation mistakes can undermine the credibility of your financial documents. Always verify totals before sending out invoices.

- Inconsistent Pricing: Using different rates for the same services can confuse clients. Establish and maintain uniform pricing to avoid discrepancies.

By being aware of these common mistakes, businesses can enhance their financial interactions and foster better relationships with clients.

Importance of Accurate Estimates

Providing precise assessments is crucial in any service-oriented industry. When clients receive a reliable prediction of costs, it fosters trust and transparency in the relationship. This practice not only enhances customer satisfaction but also minimizes misunderstandings that can arise from vague or inflated pricing.

First and foremost, accurate predictions help in establishing clear expectations. Clients appreciate knowing the potential expenses involved before committing to any work. This clarity can lead to informed decisions, enabling them to budget effectively.

Moreover, precise evaluations contribute to operational efficiency. By outlining specific requirements and potential challenges, service providers can allocate resources more effectively, avoiding delays and unnecessary expenses. This, in turn, promotes a smoother workflow and better time management.

In conclusion, the significance of delivering exact assessments cannot be overstated. It builds a foundation of trust, enhances customer experiences, and optimizes the overall operation of services offered. Adopting a commitment to accuracy in estimates ultimately benefits both clients and providers alike.

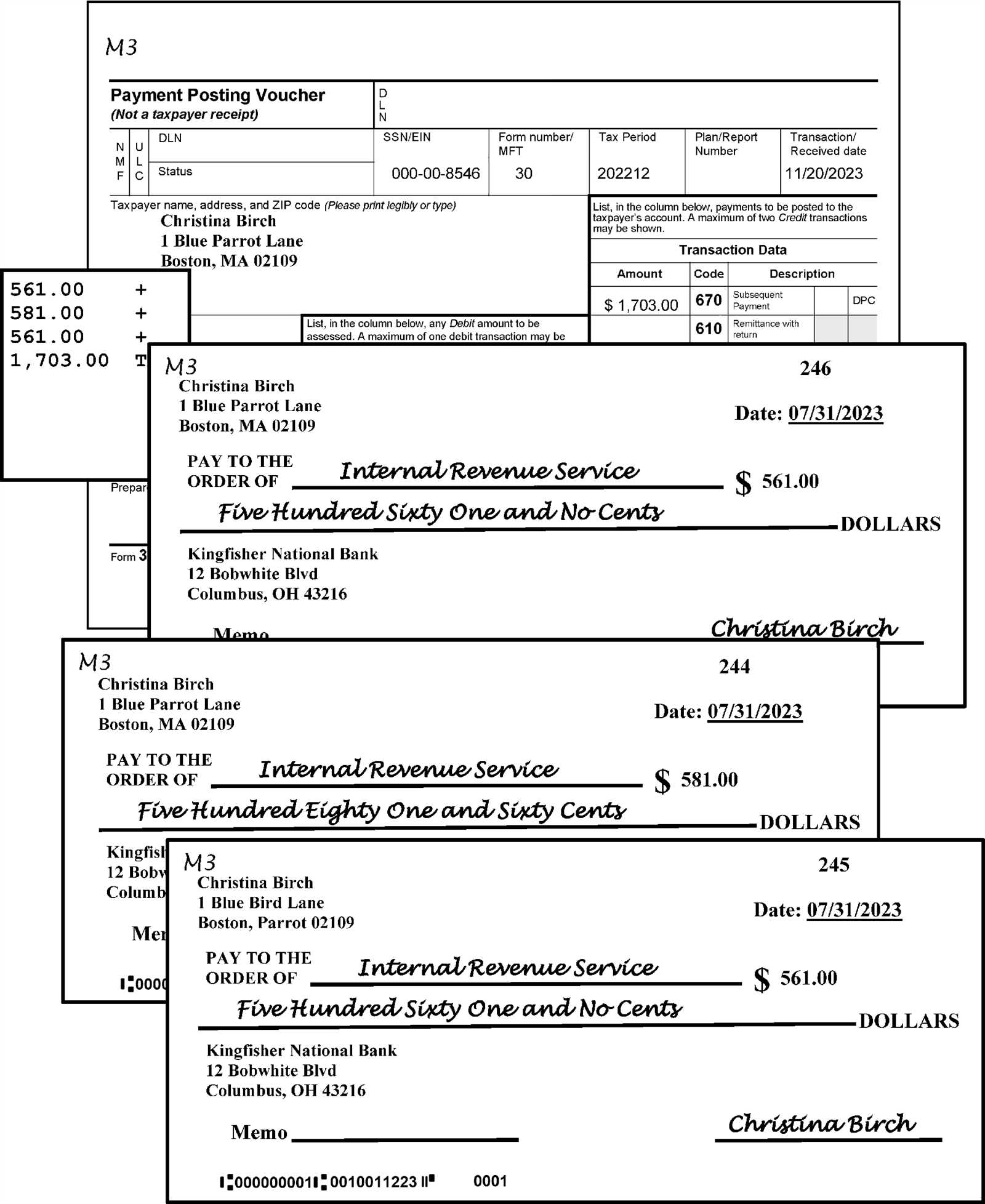

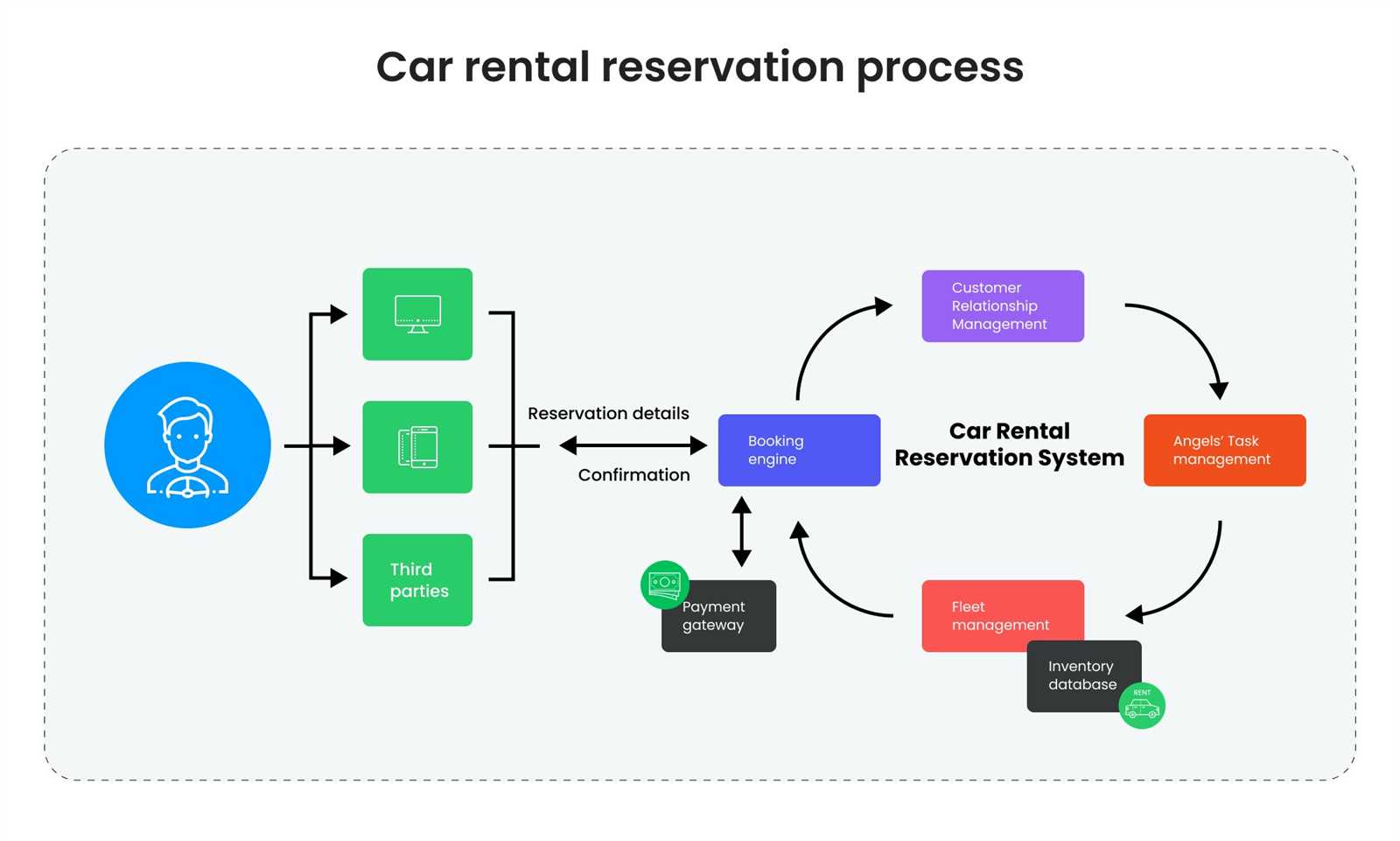

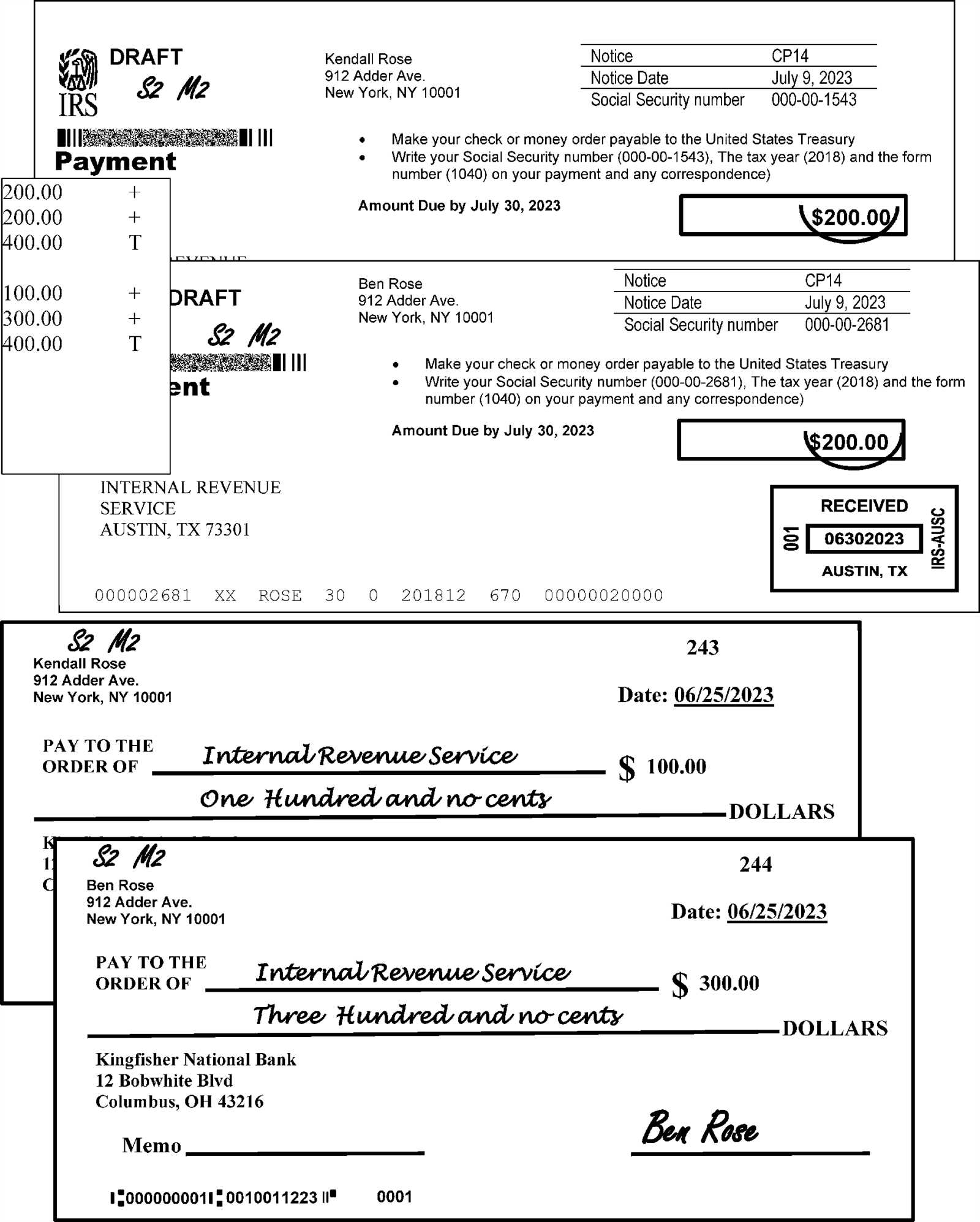

Methods of Payment in Car Repairs

When it comes to vehicle maintenance services, understanding the available payment options is essential for customers. Various methods can accommodate different preferences and financial situations, making the transaction process smoother for both clients and service providers.

| Payment Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Cash | Direct payment using physical currency. | No transaction fees; immediate settlement. | Less secure; may not be practical for large amounts. |

| Credit/Debit Card | Payment made through bank-issued cards. | Convenient; often includes rewards or cash back. | Potential transaction fees; requires electronic processing. |

| Financing | Borrowing funds to pay for services, typically through installment plans. | Allows for larger expenses to be manageable; builds credit. | Interest costs; commitment to long-term payments. |

| Mobile Payments | Using smartphone applications to transfer funds electronically. | Fast and convenient; often secure with encryption. | Requires technology; not universally accepted. |

| Checks | Written orders directing a bank to pay a specific amount. | Good for larger sums; no need for immediate cash. | Processing time; may bounce if funds are insufficient. |

Choosing the right payment method can significantly enhance the overall experience of service transactions. Customers should consider factors such as convenience, security, and potential fees when making their decisions.

Handling Customer Disputes Effectively

Addressing conflicts with clients is an essential aspect of maintaining a positive relationship and ensuring customer satisfaction. This section explores strategies to navigate disagreements constructively, fostering understanding and resolution. By employing effective communication techniques and empathy, businesses can turn potential disputes into opportunities for improvement.

Active Listening and Empathy

One of the most critical skills in resolving conflicts is active listening. Pay close attention to the customer’s concerns without interrupting. This shows respect and allows for a clearer understanding of the issue at hand. Demonstrating empathy by acknowledging their feelings can help de-escalate tension and make clients feel valued.

Clear Communication and Solutions

Once the concerns are understood, it’s vital to communicate clearly about potential solutions. Be transparent about policies and processes, and provide options that are fair and reasonable. Encourage dialogue to involve the customer in the resolution process, which can lead to a more satisfactory outcome for both parties. By remaining calm and professional, you can effectively manage disputes and maintain a positive image for your organization.

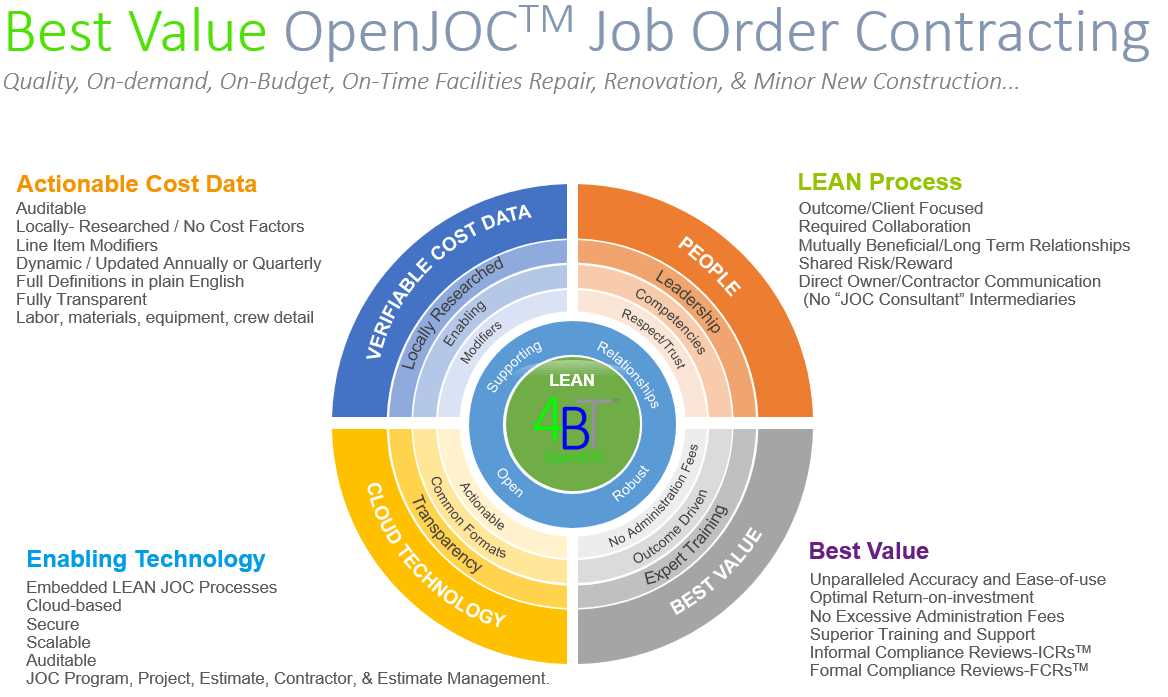

Integrating Technology into Billing

The integration of modern technology into financial operations has revolutionized how businesses manage transactions. Utilizing advanced tools not only streamlines processes but also enhances accuracy and efficiency. By leveraging digital solutions, organizations can ensure a smoother experience for both staff and clients, minimizing errors and improving overall satisfaction.

Streamlined Processes

With the adoption of software platforms, entities can automate routine tasks, reducing the time spent on manual entries. This automation allows for quick updates and real-time tracking, ensuring that all financial activities are monitored closely. Additionally, features such as electronic invoicing and online payment options can facilitate faster transactions, thereby enhancing cash flow.

Improved Accuracy and Transparency

Implementing technology not only increases precision but also fosters trust among clients. Automated systems reduce the likelihood of human error, ensuring that all figures are correctly calculated. Furthermore, providing clients with access to their accounts and transaction histories promotes transparency, encouraging a more engaged and loyal customer base. Overall, the strategic use of technology in financial operations can lead to significant improvements in both service quality and operational efficiency.

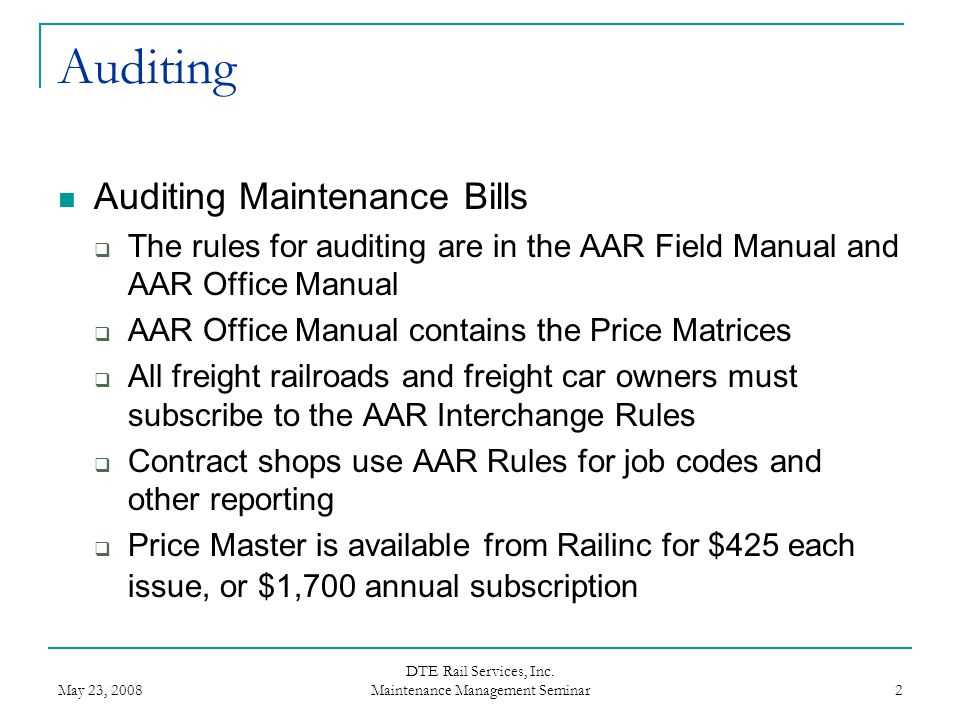

Legal Considerations in Billing Practices

Understanding the legal framework surrounding financial transactions is essential for any business engaged in service delivery. Compliance with regulations not only protects the organization but also builds trust with customers. A well-defined approach to invoicing and payment collection is crucial in avoiding disputes and ensuring adherence to applicable laws.

Key Legal Frameworks

Various laws govern financial dealings in the service industry. It’s vital to be aware of local, state, and federal regulations that may impact the way services are priced and how payments are collected. These laws can vary significantly, influencing everything from consumer rights to permissible fees.

| Legal Aspect | Description |

|---|---|

| Consumer Protection Laws | Regulations that ensure fair treatment of customers and prohibit deceptive practices. |

| Contract Law | Guidelines governing agreements between service providers and clients, including payment terms. |

| Tax Obligations | Requirements for reporting income and collecting sales tax, as mandated by law. |

Best Practices for Compliance

To minimize legal risks, businesses should implement clear communication with clients regarding costs and payment schedules. Detailed invoices that outline services rendered, associated charges, and terms of payment can help mitigate misunderstandings. Regular training for staff on legal requirements and ethical billing practices is also advisable to ensure consistency and adherence to the law.

Best Practices for Transparent Billing

Ensuring clarity and openness in financial transactions is essential for fostering trust between service providers and clients. This section highlights effective strategies to achieve transparency in invoicing, ultimately enhancing customer satisfaction and loyalty.

Implementing straightforward communication regarding costs and services can prevent misunderstandings and disputes. Here are some recommended practices to consider:

| Practice | Description |

|---|---|

| Itemized Invoices | Break down charges into individual components, allowing clients to see exactly what they are paying for. |

| Upfront Estimates | Provide clear estimates before any work begins, detailing potential expenses and obtaining client approval. |

| Regular Updates | Keep clients informed about any changes in scope or costs throughout the service process. |

| Clear Payment Terms | Outline payment expectations, including deadlines and accepted methods, to avoid confusion. |

| Accessible Support | Offer easy access to support for any billing inquiries, ensuring clients feel valued and heard. |

By adopting these practices, service providers can create a more transparent environment, leading to stronger relationships and increased client trust.

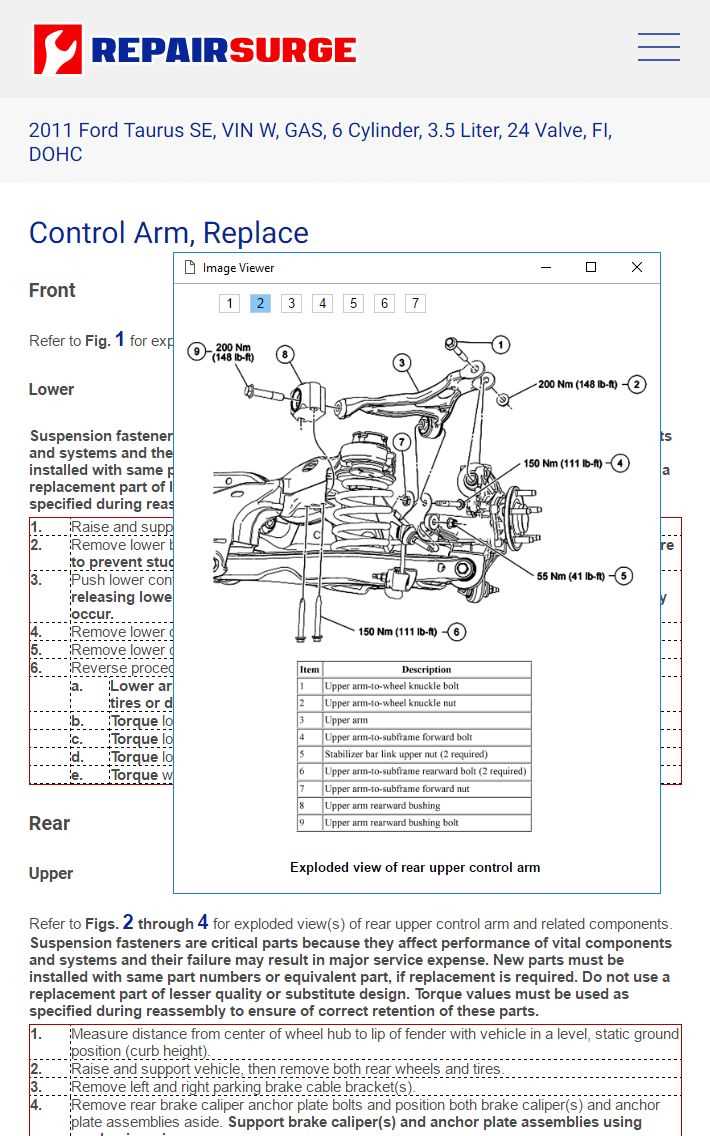

Tracking Labor and Parts Costs

Monitoring expenses related to workforce and components is essential for maintaining financial health in any service-oriented business. Accurate tracking enables effective budgeting, pricing strategies, and overall profitability assessment. This section outlines best practices for documenting and managing these crucial costs.

Importance of Accurate Tracking

Understanding the significance of precise cost tracking can enhance operational efficiency. Key benefits include:

- Improved financial forecasting

- Enhanced decision-making capabilities

- Increased transparency in financial reports

Methods for Tracking Costs

Implementing effective methods for tracking labor and component expenses is vital. Consider the following approaches:

- Time Management Systems: Utilize software tools that accurately record employee hours and project time allocations.

- Inventory Management: Keep a detailed log of parts used, including purchase prices and quantities.

- Cost Analysis Reports: Regularly generate reports that summarize total expenditures and analyze trends over time.

By adhering to these strategies, businesses can achieve better control over their financial performance, ensuring sustainable growth and efficiency in operations.

Training Staff on Billing Procedures

Effective training of personnel is crucial for ensuring a seamless and efficient financial process within any service-oriented business. By equipping team members with the right knowledge and skills, organizations can enhance accuracy, reduce errors, and improve customer satisfaction. This section outlines essential elements for instructing staff in financial operations, focusing on best practices and engagement techniques.

Key Training Components

To foster a deep understanding, the training should encompass various aspects, including the fundamental concepts of invoicing, payment processing, and record-keeping. Utilizing interactive sessions allows employees to actively participate, facilitating better retention of information. Incorporating real-world scenarios can also provide practical insights, helping staff to relate theory to actual situations.

Ongoing Support and Evaluation

Post-training support is vital for reinforcing knowledge. Establishing a feedback loop enables continuous improvement, allowing team members to express challenges and seek clarification. Regular assessments, both formal and informal, can gauge understanding and highlight areas needing additional focus. This commitment to development ensures that the staff remains confident and competent in their roles, ultimately contributing to a more effective operational framework.

Customer Communication During Repairs

Effective interaction with clients throughout the service process is essential for building trust and ensuring satisfaction. Clear and timely communication can help manage expectations, reduce anxiety, and foster a positive relationship between the service provider and the customer.

Key Communication Strategies

Adopting proactive communication strategies can significantly enhance the customer experience. Here are some essential practices to consider:

| Strategy | Description |

|---|---|

| Initial Assessment | Provide a thorough explanation of the initial evaluation and any findings, ensuring the customer understands the situation. |

| Regular Updates | Keep the customer informed about progress and any unexpected issues that arise during the process. |

| Final Review | Discuss the completed work, ensuring the customer understands what was done and why it was necessary. |

Utilizing Technology

Incorporating modern technology can streamline communication efforts. Utilizing tools such as SMS updates or service apps allows customers to receive real-time information, enhancing their overall experience.

Reviewing and Updating Billing Policies

Regularly assessing and refining financial guidelines is essential for maintaining transparency and fairness in service transactions. This ongoing process ensures that the organization remains adaptable to changes in the market and client expectations while fostering trust and loyalty among customers.

Periodic Evaluation of existing policies allows for the identification of areas that may require adjustments. Analyzing customer feedback and examining competitive practices can reveal valuable insights. It is crucial to stay informed about industry trends and legal requirements that may impact financial practices.

Engaging Stakeholders in the review process enhances the effectiveness of policy updates. Involving staff members who directly interact with clients can provide practical perspectives on the challenges they face. Additionally, soliciting input from customers can lead to improvements that directly address their needs.

Once revisions are made, clear communication of the updated policies is vital. Ensuring that all stakeholders understand the changes and the reasons behind them promotes a smoother transition and reinforces the organization’s commitment to transparency.

Finally, establishing a regular review cycle can help ensure that financial guidelines remain relevant and effective over time. By committing to continuous improvement, the organization can better serve its clientele and adapt to an evolving marketplace.